A new tool tracking the progress of anti-money laundering (AML) supervision shines a light on the real weaknesses and inconsistencies in the current supervisory regime and underscores the urgency of reform.

Bringing together data scattered across various official reports in one place for the first time, the tracker is designed to provide policymakers and the public with unique insights into how well AML supervision is working in the UK.

While the Government has made the welcome announcement that it will move supervision of lawyers, accountants and company formation agents to the Financial Conduct Authority (FCA), it has caveated this by saying that it is “heavily dependent” on finding time to pass legislation in parliament.

But given the serious issues with AML supervision exposed by the tracker, as well as official findings that many sectors remain at high risk of money laundering, urgent measures to improve its effectiveness can’t come a moment too soon. The UK’s proposed model is already being touted as a way to tackle money laundering in other jurisdictions, and the UK has an opportunity to show real leadership ahead of the proposed Countering Illicit Finance Summit and an impending visit by the Financial Action Task Force in pushing this reform forward.

What is the tracker for?

Alongside showing the urgent need to push ahead AML supervisory reforms the government has committed to, the AML supervision tracker’s key aims are twofold.

First, it will help hold supervisors to account for improving the effectiveness of their AML supervision during the time it takes for the 22 professional bodies’ supervisory responsibilities for lawyers and accountants to be passed to the FCA.

Second, the tracker will help monitor supervision over the longer term once the FCA settles into its new role as an AML super-regulator, providing insights into whether this reform results in more effective supervision.

What data does the tracker visualise?

The tracker features four charts which each highlight different aspects of AML supervision:

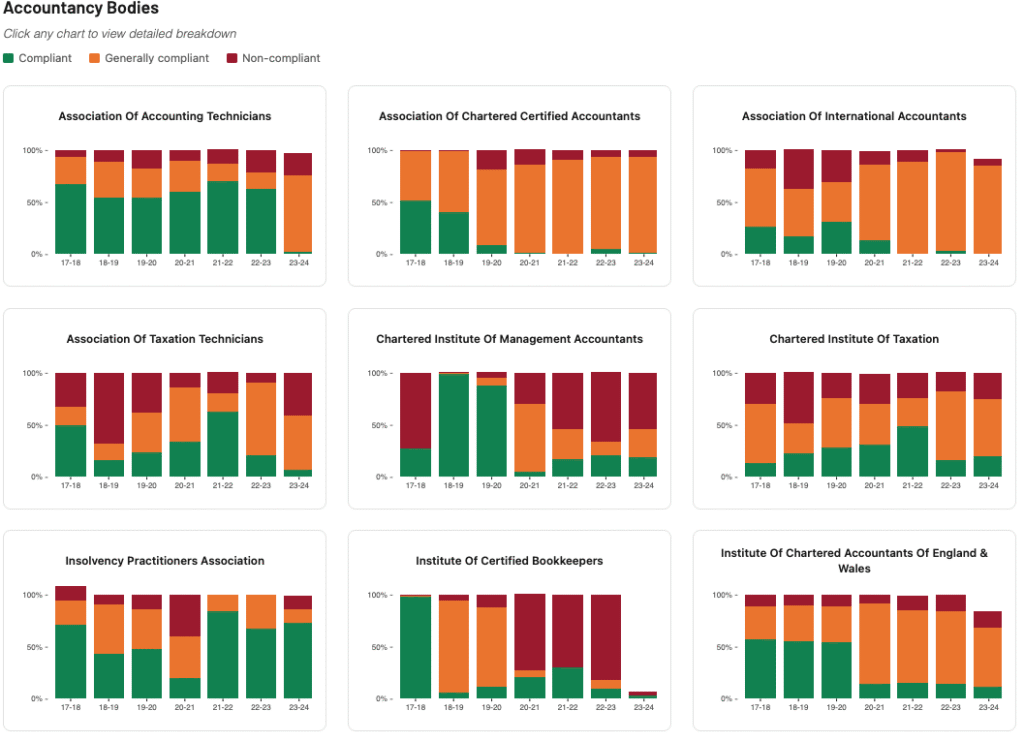

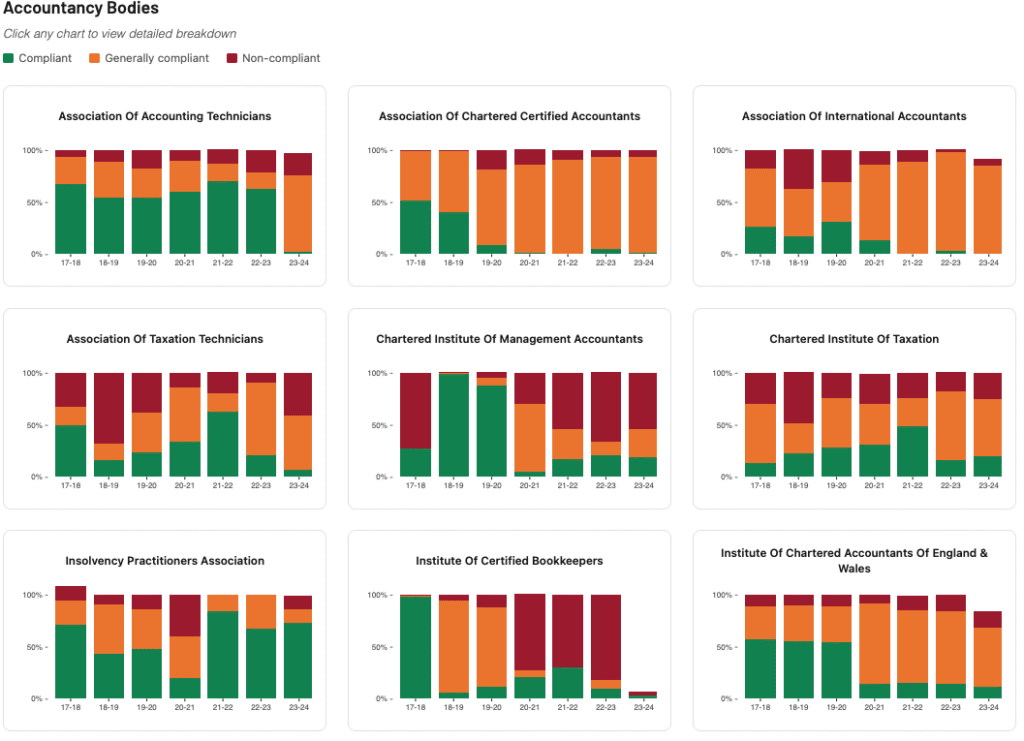

- The first chart displays compliance outcomes resulting from supervisors’ reviews of firms for their compliance with the Money Laundering Regulations (MLRs) as well as the annual number of reviews done by each supervisor.

- The second shows how much supervisors are using informal actions (such as guidance or reminder letters and engagement with firms to correct errors) versus formal actions (such as fines or cancellations of membership or registration) when non-compliance is identified.

- The third focuses on how often supervisors use the strongest sanctions they have available: fines and cancellations of membership or registration.

- The final chart tracks how well supervisors are resourced in comparison to the number of firms they supervise.

What trends does the tracker reveal?

At risk of stating the obvious, the tracker reveals that the UK’s patchwork of 25 different supervisors has resulted in serious inconsistencies and unevenness in the approach to supervising and enforcing compliance with the MLRs. While this can make it difficult to draw direct comparisons, there are some striking trends that emerge from the tracker which show this fragmented system is failing to deliver effective AML supervision across the regulated sector.

1. Compliance defiance

Regulated firms have long been required to put in place measures to identify and prevent money laundering from occurring through their firms but, as highlighted in the tracker, many supervisors continue to find persistently low levels of compliance in their reviews.

There are a couple of possible explanations for this. On the one hand, some supervisors’ approach to assessing compliance may be getting tougher, with firms less likely to breeze through light touch reviews. On the other hand, it could mean that supervisors are not doing enough to deter non-compliance. Most likely it is a mix of the two, reflecting the inconsistency in supervisory approach that is undermining the integrity of the UK’s AML supervisory regime and which the welcome move to consolidate supervision in the FCA is seeking to address.

Ideally, in the coming years the tracker will show firms’ compliance levels steadily increasing, stewarded by robust supervision and proportionate sanctions when non-compliance occurs.

2. How tough are supervisors’ responses to non-compliance?

Given the prevalence and persistence of non-compliance in parts of the regulated sector, you would expect to see supervisors using the most serious, ‘formal’ sanctions available like fines and cancellations of membership but this is far from always the case. In general, supervisors appear to prefer the softly-softly approach of ‘informal actions’, raising real questions as to whether enforcement action is providing enough of a deterrent effect.

In the legal sector, the Council for Licensed Conveyancers has issued 22 times more informal actions than formal actions over the last seven years despite an average of 87% of the firms it reviewed over this time not being fully compliant with the MLRs. This is alarming given the UK property sector poses a notoriously high risk of money laundering.

Several professional body supervisors for the accountancy sector have issued a miniscule number of formal actions over the last 7 years despite their reviews finding high levels of non-compliance. The Association of Taxation Technicians for instance issued a total of just 5 formal actions in that time, despite an average of 69% of its supervised firms that it reviewed not being fully compliant with the MLRs.

HMRC has not always resorted to its strongest sanctions in cases of non-compliance though the number of fines it issues has been steadily increasing since 2019/20. The disparity between its formal and informal actions in 2023/24 was notably high, with the agency issuing 764 informal actions versus 157 informal ones despite 60% of reviewed firms not being fully compliant. Around a third of its informal actions came against firms it assessed as being at high risk of money laundering.

3. Silver linings

Some supervisors are responding to non-compliance with increasingly robust enforcement. The Solicitors Regulation Authority for instance found only 22% of its reviewed firms to be fully compliant on average over seven years, but has increased its use of formal actions accordingly, as well as driving the overall increase in legal sector fines seen in chart 3.

In the accountancy sector, the Association of International Accountants (AIA), which has found an average of just 13% of the firms it has reviewed to be fully compliant, has responded in the last two years with a significant uptick in formal actions, going from issuing just 2 in 2021/22 to 35 in 2022/23 and 41 in 2023/24.

However, neither supervisor has seen an increase yet in compliance among its members as a result of this enforcement, with the SRA’s latest annual report (not yet reflected in the tracker) showing that just 13% of law firms inspected in 2024/25 were fully compliant with AML rules and the AIA not finding a single one of its members fully compliant in 2023/24. As previously mentioned, this may well be because these and other supervisors have adopted a tougher stance on compliance and firms have not yet raised their standards to meet these heightened supervisory expectations.

Looking forward

Ultimately, the tracker confirms what many already knew – lots of firms, particularly in the professional services sector, are still failing to put in place the basic measures required to comply with their AML obligations or are failing to implement them rigorously. There have to be real concerns that this is at least in part because the consequences for non-compliance are often so mild. The situation is hardly helped by the highly fragmented and variable approach to supervision across the 25 different supervisors that the tracker so starkly illustrates.

This is why the UK government simply cannot afford to delay consolidating supervision for lawyers, accountants and company formation agents in the FCA. At the same time, it is essential that Professional Body Supervisors do not take their foot off the pedal during the transition period and leave the UK economy even more exposed to damaging flows of dirty money.

Note: this article was amended on 1 December 2025 to update compliance statistics for the Council for Licensed Conveyancers and Association of Taxation Technicians.